New Flexible Pathways

Current Challenge

- Forced track structure lacks flexibility and customization

- Highly specialized tracks are less relevant for developing markets

SOA Shift

- Shifting from "tracks" to a flexible pathway

- Flexibility to focus on a single practice area or create a combination of courses relevant to you

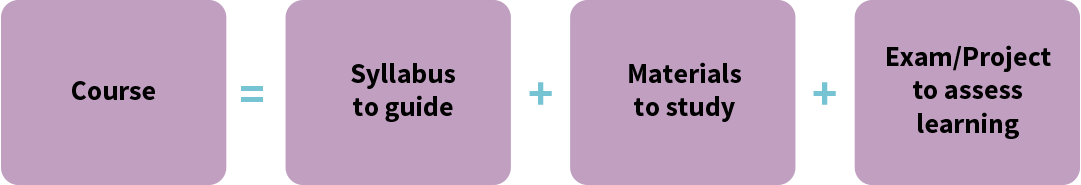

5 Courses required:

4 Technical courses (one must build on another)

1 Decision Making and Communications (DMAC) course

+ Fellowship Admissions Course (FAC)

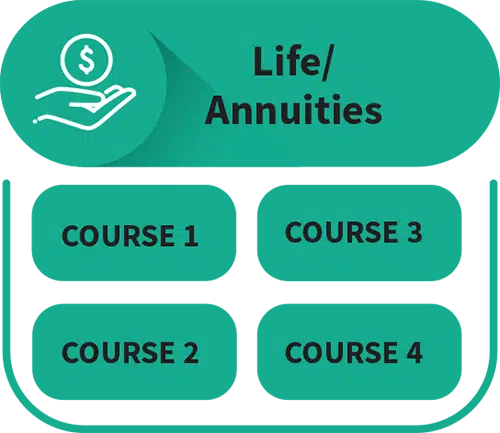

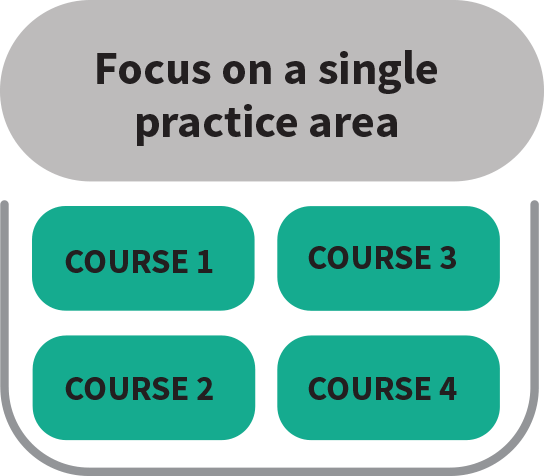

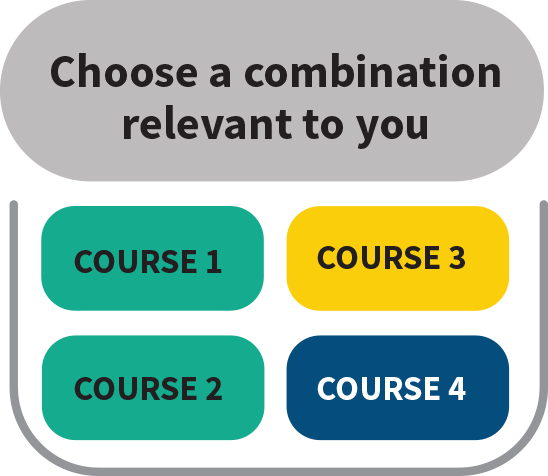

With a flexible FSA pathway, you have the ability to focus on a single practice area or create a combination of courses that align with your current career or future aspirations. With more options, you can concentrate on the material that is most relevant to you, while preserving the high standards of the credential.

Complete four technical courses, including two in the same subject area where one builds on the prior course. The Decision Making and Communication (DMAC) course and Fellowship Admissions Course (FAC) round out your pathway. You can still concentrate in a single practice area by choosing four technical courses from that specialty.

Choose from About 20 Courses

Courses are currently being developed and will be announced in the future.

Choose Your Path

Or

Theoretical Examples of Crafting Your Path

Here are some hypothetical examples of how the SOA’s course options could work for you.